Macroeconomic Analysis – The Current Inverse Relationship Between the US Dollar and the S&P 500

Introduction

As a follower of technical analysis, you must pay attention to the macroeconomic trends that are playing out in our world. For the world economy, there is no more powerful macroeconomic relation than the current inverse correlation between the US stock market and the US Dollar. This correlation has been observed over the years and has significant implications for the US economy and the global economy. In this blog post, we will explore the reasons behind this correlation, its impact on the stock market, and its influence on international trade.

What are the S&P 500 and the US Dollar?

Before we delve into the topic of the inverse correlation between the S&P 500 ($SPY) and the US Dollar ($DXY), let us first define these terms. The S&P 500 is an index of 500 large-cap stocks that represent the US economy. It is widely regarded as a benchmark for the overall performance of the US stock market. The US Dollar, on the other hand, is the official currency of the United States and is used as a medium of exchange for international trade.

What is the Inverse Correlation between the S&P 500 and the US Dollar?

The inverse correlation between the S&P 500 and the US Dollar refers to the price relationship between these two entities. This price correlation suggests that when the price of the US Dollar increases, the S&P 500 tends to decrease in price, and vice versa. In other words, there is an inverse relationship between the price of the US Dollar and the performance of the US stock market.

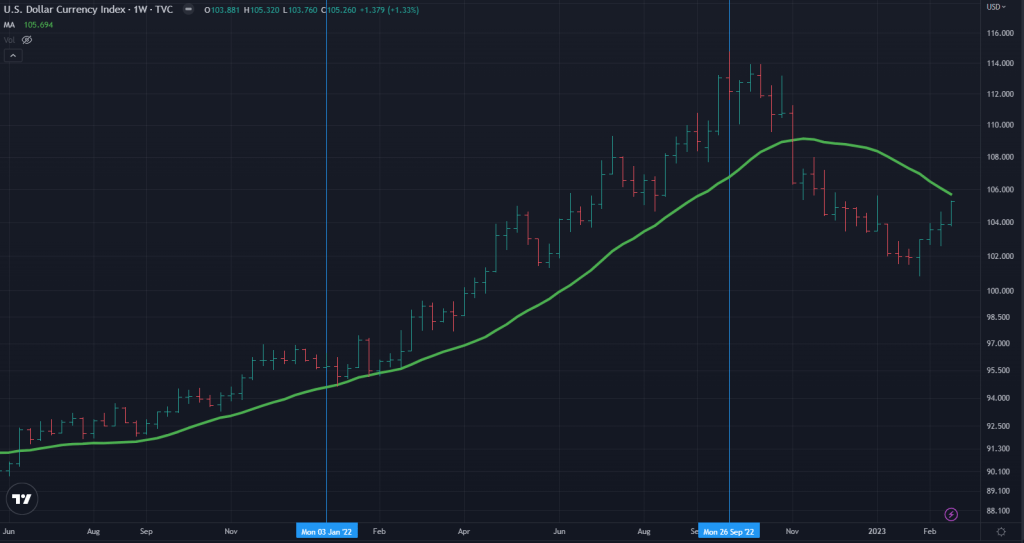

Take a look at the charts of the US Dollar and the S&P 500 from September 2022, to now in February 2023. Investors and traders alike loved the US Dollar in September of 2022 and this was evident from the blow off top that occurred late in that month. The US Dollar was even featured on the cover of Barron’s in October of 2022. All the while, there was a market rotation forming beneath the surface.

($DXY chart on top. $SPY chart on bottom)

Just when everyone was loving the US Dollar and hating the S&P 500, the S&P 500 bottomed and went on to rally 19.78%, with the US Dollar falling 13.36%. If you take a look at the vertical lines shown in the US Dollar vs S&P 500 chart, you can see that tops in the US Dollar lead to bottoms in the S&P 500.

Why is there an Inverse Correlation between the S&P 500 and the US Dollar?

There are several reasons why there is an inverse correlation between the S&P 500 and the US Dollar. One of the primary reasons is that the US Dollar is the world’s reserve currency. This means that it is used as a medium of exchange for international trade, and many countries hold US Dollars in their foreign exchange reserves.

When the US Dollar increases in value, it becomes more expensive for other countries to buy US goods and services. This can lead to a decrease in demand for US exports, which can hurt US companies and lead to a decrease in the stock market. Conversely, when the US Dollar decreases in value, it becomes cheaper for other countries to buy US goods and services. This can lead to an increase in demand for US exports, which can help US companies and lead to an increase in the stock market.

($DXY in an uptrend dating back to mid-2021 and topping in September of 2022)

($SPY topping in January of 2022 and bottoming in September of 2022)

Another reason for the inverse correlation between the S&P 500 and the US Dollar is that the US economy is heavily reliant on exports. Many large-cap companies listed on the S&P 500 generate a significant portion of their revenue from foreign countries. When the US Dollar decreases in value, these companies can sell their products and services at a lower relative price, making them more competitive in the global market. This, in turn, can lead to an increase in international demand for their products and an increase in their stock prices.

Conversely, when the US Dollar increases in value, these companies may struggle to compete in the global market. This can lead to a decrease in international demand for their products and a decrease in their stock prices. This can also lead to a decrease in profitability for these companies, which can have a broader impact on the overall stock market.

Impact of Inverse Correlation on the Stock Market:

The Federal Reserve, also known as the Fed, is the central bank of the United States. It is responsible for setting monetary policy and regulating the US banking system. The Fed has a significant impact on the US economy and can influence the value of the US Dollar and the stock market.

The inverse correlation between the US Dollar and the S&P 500 can also impact the stock market through its influence on interest rates. When the value of the US Dollar increases, the Federal Reserve may raise interest rates to prevent inflation. When interest rates are rising, the cost of debt increases and companies are forced to pay more in monthly interest expenses. When companies are paying more for debt, their earnings will decrease, resulting in lower profit margins and lower stock prices.

On the other hand, when the value of the US Dollar decreases, the Federal Reserve may lower interest rates to stimulate economic growth. Lower interest rates spur businesses to increase their investments and reduce the amount of monthly debt interest they have to pay. All things equal, lower interest rates improve a business’ profit margins, leading to stock price gains.

Conclusion:

The US Dollar and the S&P 500 are currently trading with an inverse relationship. The driving force of this relationship is coming from today’s inflationary environment. With the Fed raising interest rates, the US government debt becomes attractive to investors, leading to an increase in the US Dollar. On the other hand, a majority of the companies within the S&P 500 are being hurt by rising interest rates. Increased cost to service debt lead to reduced profit margins for the US’ largest businesses.

As with any correlation, there will be times when the US Dollar and the S&P 500 lose their inverse relationship. These two assets tend to have the strongest inverse relationship when there is a strong trend in interest rates. So, watch the Fed. If interest rates keep rising, this inverse relationship will stay true.

Leave a comment