Tag: Investing

-

The Commodity Renaissance: How to Navigate the Next Market Supercycle

Commodities have been a forgotten asset class for 99% of investors. Doing a quick search, the average investor dedicates 3-5% of their total portfolio value to commodities. Digging deeper, of that 3-5%, 50-70% of that allocation is represented by gold. But there is a much larger world of commodities available for investment. ETFs have given…

-

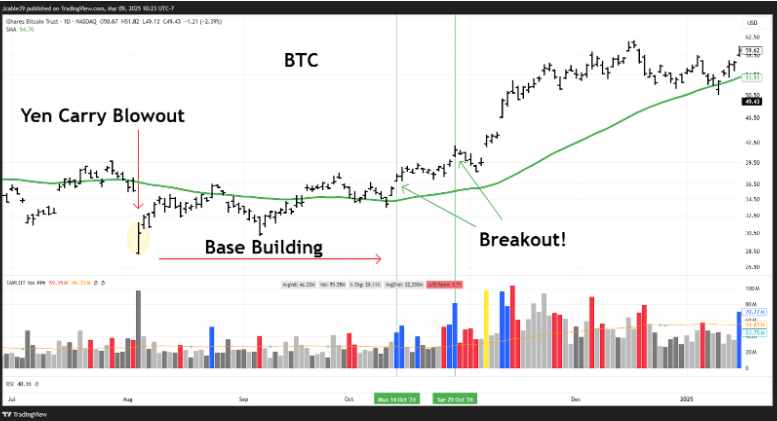

Navigating the Crypto Market: From Breakout Trades to Long-Term Accumulation

Navigating the Crypto Market: From Breakout Trades to Long-Term Accumulation Introduction The crypto market is a constant cycle of euphoria and fear, rewarding those who can adapt to shifting conditions. My approach has always been rooted in technical signals, focusing on trend strength, volume, and momentum indicators to guide both trading and investment decisions. This…

-

Intermarket Analysis: Assessing Economic Growth Expectations through the SPY/TLT Ratio and Key Equities

Intermarket analysis has been a cornerstone of technical analysis since John J. Murphy published Intermarket Analysis: Profiting from Global Market Relationships in 1991. While technicians have long studied relationships between asset classes, Murphy was the first to formalize a framework for using these relationships to improve portfolio performance. One of the most effective ways to…

-

Strong Dividend Growth Stocks on Sale: MUSA, BX, and UNH Offer Unique Investment Opportunities Amid Market Weakness

A dividend growth stock is a type of equity investment that consistently increases its dividend payments over time, offering investors a growing stream of passive income. The key characteristic of such a stock is its dividend growth percentage, which reflects how much the dividend has increased year-over-year. Ideally, a dividend growth stock will show a…

-

Laggers are Leading in 2023

2022: THE YEAR OF PAIN 2022 was a tough year for many market participants. The benchmarks for the United States economy, S&P 500 ($SPY), NASDAQ 100 ($QQQ) and the Dow Jones Industrial Average ($DIA) all had losing years. These indices were down 16.58%, 30.05% and 6.19%, respectively. (2022 performance of $SPY, $QQQ and $DIA) This…

-

Igniting A Bull Case for 2023 – Bullish RSI Divergence

Link to YouTube Video: https://www.youtube.com/watch?v=7mxiNbHGNlw Introduction: Forming a bottom in the market is a process, not a single event in time. Bottoms take time to form. You need a transfer of shares from weak hands to strong and investors need a chance to reinforce/re-evaluate their investment thesis. It takes more than a stock breaking out…